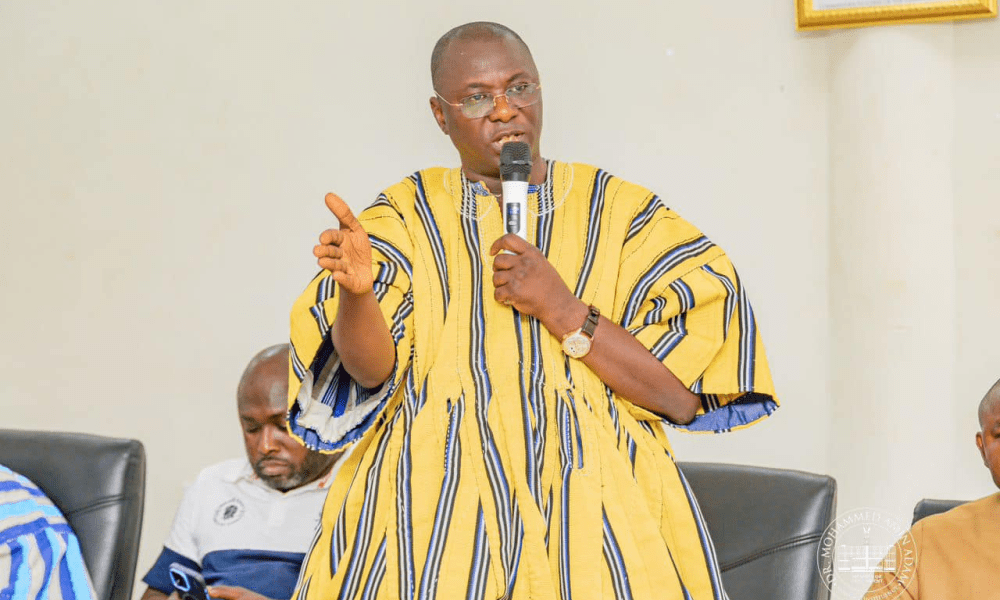

Former Finance Minister, Mohammed Amin Adam, has raised deep concerns about the government's current approach to public financing, cautioning against the subtle pressure being mounted on investors-particularly pension funds-to participate in bond markets that may not offer favourable risk-reward outcomes.

In a statement issued on July 16, 2025, the former minister warned, "Investors, especially pension funds, must not be unfairly pressured to participate in the bond market.

They should only do so after a careful and balanced consideration of cost and risk." Amin Adam's concerns come amid what he describes as growing evidence of fiscal instability under the NDC administration.

He pointed to the 2025 national budget, which projected a total financing requirement of GHS56.91 billion-comprising GHS36.99 billion in net domestic financing and GHS21.41 billion in foreign net financing. "Yet, as of July 11, 2025, data from the auction market indicates that over GHS6 billion has already been spent on repayments," he disclosed. "This means the government is diverting resources away from vital sectors to cover auction shortfalls." According to him, this situation has created a ripple effect that is now impacting the delivery of key government programs. "Many flagship initiatives remain underfunded," he revealed, "as ministers have begun to openly express frustration over persistent cashflow constraints, even for budget lines that were approved by Parliament." Amin Adam also took a swipe at the NDC government for delaying payments to contractors, noting that funds are now being sought from the World Bank to meet those obligations. "This is happening despite the Ghana Revenue Authority exceeding its half-year revenue target by about GHS4 billion," he said.