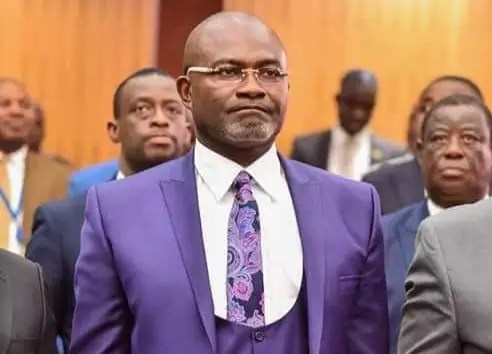

Alhaji Seidu Agongo: The Silent Philanthropist Sustaining Hopes And Realising Dreams

Paul’s Lutheran School near the state-owned Ghana Broadcasting Corporation (GBC) in Accra, so that he could use the savings he made on his children’s school fees, to sponsor the 81 poor pupils up to the university level.Presenting the citation to Mr Agongo at a PTA meeting on Wednesday, 27 February 2019, Mrs Fatimah Carol Yamusah, the Admissions Coordinator of St.

The Group also makes a yearly GHS50,000 donation to single mothers, all with the sponsorship of Alhaji Agongo.DISTRIBUTING MOBILE MONEY TO 10,000 WIDOWS, SINGLE MOTHERS DURING COVID LOCKDOWN In the heady days of the COVID-19 outbreak in Ghana in 2020, Alhaji Agongo, in an attempt to mitigate the impact of a three-week partial lockdown in Greater Accra and Greater Kumasi, launched an e-charity programme through which he disbursed cash to some 10,000 widows, single mothers and the underprivileged across the country through mobile money platforms.It was to his little support to help them to cope with the financial challenges that the pandemic brought. His intervention benefitted more than 4,600 widows, single mothers and other lessprivileged people in the Greater Accra and Ashanti regions in April.Alhaji Agongo, who said helping the poor makes him feel human, explained that although his initial target was to support 600 people through the intervention, he had to revise the figure upward after noticing that many people were going through financial difficulties, as a result of the partial lockdown.He said he reached this conclusion after his radio stations that were advertising the support scheme got inundated with calls far beyond the numbers that were projected. As a result, he said he revised the initial target to 10,000 people.The support programme, Alhaji Agongo noted, was christened the 'CMG MoMo for Lockdown' and implemented in association with his Class Media Group (CMG).People who were disadvantaged, he explained, were encouraged to call telephone numbers advertised on the group’s 10 radio stations, a television station and an online portal in Accra, Kumasi, Tamale, Takoradi and Ho to give their personal and mobile money details and their economic conditions.A group of people then vetted the information and those found to be authentic received the money.The amount sent to the beneficiaries, he noted, varied from person to person, taking into consideration the individual’s situation and the number of children, among others.“What matters in life is the impact you make in peoples’ lives.

Different people are making impact in different ways but everybody and his choice; my choice is the widows, the single mothers, the underprivileged children and also to create employment,” he said.ESSENCE OF GIVINGAlhaji Agongo sees philanthropy as a way to share the blessings of God with those in need.“Islam teaches about giving but I go beyond Islam.”“What I believe is that life has realities and be it the Bible or the Quran, the holy books tell us that you will be judged according to your own deeds.“So, I believe that whatever blessings God has blessed me with, God knows why He has blessed me with that and, of course, God will also know the fact that the blessing he gave me, I did not utilise the blessing alone; I also tried to bless others,” he explained.Alhaji Agongo, who held the most significant shares of the now-defunct Heritage Bank Limited, which was collapsed in 2019, said: “To be very honest with you, I just don’t get up and do anything.

The programme's primary aim is to uplift and empower individuals, particularly those facing economic hardships.ALHAJI AGONGO OFFERS TO HELP FELLOW BANK OWNER PRINCE KOFI AMOABENGDespite his focus on helping the poor and vulnerable, Alhaji Agongo also extends assistance to people who may have fallen from grace to grass due to circumstances that may have connived against them unjustly.In October 2022, UT Bank founder Prince Kofi Amoabeng expressed gratitude to Alhaji Agongo for being the only Ghanaian who offered to assist him after a selfie of him wearing a scruffy beard with a sad face went viral on social media and got Ghanaians rumouring that he was now a pauper on the verge of death following the collapse of his bank.Speaking to Nana Otu Darko on CTV’s breakfast show, Dwabre Mu, on Tuesday, 4 October 2022, Mr Amoabeng said the only reason he accepted an invitation to appear on that show was because the station belonged to Mr Agongo’s Class Media Group.“Actually, the reason why I couldn’t say no to your invitation was because of his [Seidu Agongo’s] personality,” Mr Amoabeng told Nana Otu Darko, adding: “I’ve never set eyes on him but at some point in time, after the COVID-19 pandemic hit, I started wearing this beard and I took a picture of myself and I posted it on [social media] and that set tongues wagging that ‘I was on the verge of death’, ‘I’m now a pauper’, but the boss of this place [CMG], Seidu Agongo, sent me a WhatsApp message that if I’m in difficulty, I should send him my account number for him to give me some money.”“Of course, I didn’t pursue it but I’m ever so grateful that, at least, one Ghanaian thought that 'instead of laughing at him, let me help',” he noted.BANK OF GHANA WAS ORDERED TO COLLAPSE AGONGO’S HERITAGE BANKIn that same interview, Mr Amoabeng said the Bank of Ghana was told by officialdom to collapse Mr Agongo’s Heritage Bank Limited.Mr Amoabeng, whose bank was also collapsed in the first term of the Akufo-Addo government, told Nana Otu Darko that: “I was pained by the collapse of Heritage Bank because it was young.”“The Bank of Ghana had issued a licence to Heritage Bank and Heritage Bank had not operated for long and, so, unlike UT Bank, it had no bad loans or anything and it was a wholly-owned Ghanaian company that we had to nurture to grow,” he explained.“Secondly, the owners of Heritage Bank found it fit to appoint a solid board,” he noted, adding: “I mean, the chairman was [Prof] Kwesi Botchwey.

That is why I mentioned that Heritage Bank, for example, was collapsed out of sheer wickedness,” he added.Mr Amoabeng observed that the “unfortunate thing is, the Bank of Ghana is supposed to be independent but I don’t think they were independent with their decision on Heritage Bank because, if they were independent, why do you issue a licence and withdraw it?”“When you were issuing the licence, didn’t you know the owners and the board?” he asked.“It means they were told to withdraw the licence,” he deducted.“And it’s not a fair way but it’s another dangerous path that Ghana has taken,” he regretted, noting: “Every institution has been politicised including even the army.”“And that is why I am saying that for Heritage Bank, the institution that is supposed to be independent of the government, even though in principle, issues a licence and then withdraws that licence when the company hasn’t even done anything wrong,” Mr Amoabeng added.Mr Amoabeng made similar comments some years prior, saying he found it “extremely odd” for the Bank of Ghana to have collapsed Heritage Bank Limited, which had no bad loans on its books and was being run by the “right people” within the industry.In his view, the revocation of the licence of the Ghanaian-owned bank, whose founder, Mr Agongo, has always argued, was above board, as far as its books were concerned, was not only politically motivated but also “extremely unfair and unfortunate.”Asked directly by TV3’s Paa Kwesi Asare in an interview on Business Focus: ‘Do you think, as many think, that some of the decision to close down certain banks was politically motivated?’ Mr Amoabeng answered: “A few of them; specifically Heritage Bank.”“I don’t understand the issue because the Chairman of the Board is Dr Kwesi Botchwey.

I can say that for him,” Mr Amoabeng, whose bank, along with eight others, were collapsed in the central bank’s financial clean-up exercise in President Nana Akufo-Addo’s first term of office, noted.“So,” Mr Amoabeng noted, “I find it extremely odd that a bank – and it had not started doing business for it to have bad loans and all those things – and for you to say that the owner didn’t have what it takes [doesn’t meet the fit-and-proper criterion] or however they put it, I mean the owner doesn’t run the bank, he’s a Ghanaian, he’s got the money, he’s appointed the right people to run the bank for him, so, what is the excuse?”“I find that extremely, extremely unfair,” Mr Amoabeng asserted, adding: “Maybe I don’t have all the facts, but from where I stand, I find it really unfortunate.”The Bank of Ghana revoked Heritage Bank’s licence on Friday, 4 January 2019, on the basis that Mr Agongo, the majority shareholder, among other things, used proceeds realised from alleged fraudulent contracts he executed for the Ghana Cocoa Board (COCOBOD), for which he has been facing prosecution together with former COCOBOD CEO Stephen Opuni, for the past four years.Announcing the withdrawal of the licence, the Governor of the central bank, Dr Ernest Addison, told journalists – when asked if he did not deem the action as premature, since the COCOBOD case was still in court – that: “The issue of Heritage Bank, I wanted to get into the law with you, I don’t know if I should, but we don’t need the court’s decision to take the decisions that we have taken.We have to be sure of the sources of capital to license a bank; if we have any doubt, if we feel that it’s suspicious, just on the basis of that, we find that that is not acceptable as capital.

We believe we have been done a grave injustice and a terrible precedent set that does not bode well for the future.”"I APPRECIATE YOUNG SEIDU AGONGO AND WANT TO SEE HIM DO GREAT THINGS; IT WAS PAINFUL HIS BANK WENT DOWN" – KWEKU BAAKO In August 2020, the Editor-in-Chief of the New Crusading Guide newspaper, Abdul-Malik Kweku Baako, said he appreciates Alhaji Agongo and wants to see him succeed.Kweku Baako, thus, said he was pained a lot when the simple and unassuming hard-working businessman’s Heritage Bank was collapsed by the Bank of Ghana.“He [Agongo] is a young man and I appreciated him and I want to see a young man like him who does great things”, adding: “It was painful his bank went down”.Similarly, Kweku Baako expressed qualms about the central bank’s collapse of uniBank and GN Bank, which, respectively belonged to the former Governor of the Bank of Ghana, Dr Kwabena Duffuor and former presidential candidate Dr Papa Kwesi Nduom.“I felt for the three banks: Nduom’s bank [GN Bank], Heritage Bank that belongs to that young man, Seidu Agongo (because of his extension into radio, we met a couple of times in 2014 and 2015) and Dr Duffuor’s bank [uniBank]”, he said on Accra-based Peace FM's Kokrokoo morning show.“The same with uniBank”, he said.“I will tell [you] honestly; Dr Duffuor is a personal friend but the action taken against the banks was not right”, he added.Kweku Baako is not the first to have spoken against the collapse of Heritage Bank, in particular.AGONGO’S REBUTTAL TO BANK OF GHANAFollowing the Bank of Ghana's claim that Mr Agongo failed the 'fit and proper' test, the buisnessman responded with a press statement in which he said that the “not fit and proper” tag stamped on him by the central bank was “capricious, arrogant, malicious and in bad faith”.According to Mr Agongo, “In purportedly making the determination, the central bank obviously had little regard for the time-honoured principle that a person is presumed innocent until proven guilty by a court of competent jurisdiction”, adding that: “The fact that I have a case pending before the High Court is a matter of public knowledge but my guilt or innocence is yet to be determined by the Honourable Court”.“The determination that I am not a fit and proper person to be a significant shareholder of HBL because the central bank suspects the funds are derived from illicit or suspicious contracts with Cocobod is not only calculated to pre-judge the outcome of the criminal proceedings but also violative of the principle of presumption of innocence to which every individual is entitled.