9 banks could be insolvent from impact of domestic debt exchange – Report

Ghanaian banks will not be able to absorb losses without having to resort to a recapitalization from the government, or resorting the shareholders and banks for recapitalization quickly to mitigate the risk of bank failure and also protect the stability of the entire banking system and the economy”, it said.

Below is the research

ANALYSING THE DOMESTIC DEBT EXCHANGE PROGRAMME AND FAIR VALUE ACCOUNTING IMPACT ON LOCAL BANKS’ SOLVENCY

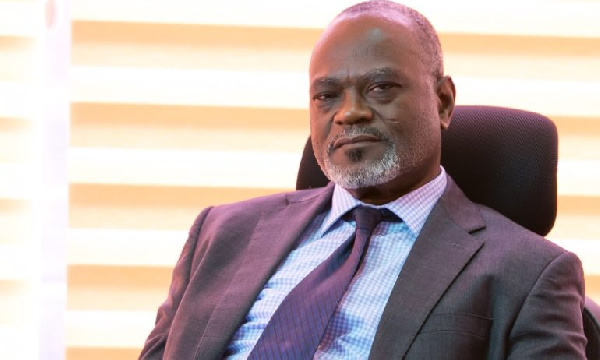

(DR RICHMOND A. ATUAHENE AND K.B. FRIMPONG FCCA)

1.0 BACKGROUND

The Ministry of Finance invited on December 5, 2022 holders of 60 old domestic debts to voluntarily exchange ¢137.3 (US$14.3) billion domestic bonds and notes including E.S.L.A and Daakye Bonds, for a package of twelve new eligible domestic bonds.

Under the debt swap or exchange announced on December 5, 2022, local holders including domestic banks, Bank of Ghana, Firms and Institutions, Retail and Individuals, Insurance Companies, Foreign Investors, Rural and Community Banks and SSNIT were to exchange ¢137.3 billion (US$14.3) worth of 60 eligible domestic bonds for 12 new eligible bonds maturing between 2027 to 2038.

Under the initial offer for bondholders with bonds maturing in 2023, the government promised four new bonds that were expected to mature in 2027, 2029, 2032 and 2037 with zero coupon rate in 2023, 5% coupon rate in 2024 and 10% coupon rate in 2025, which would continue till the maturity of last bonds in 2037.

After fierce resistance from trade unions about the inclusion of pension funds in the domestic debt exchange programme and for the lack of enough voluntary participation, the government announced the extension of the voluntary participation in the programme to January 16, 2023 with following modifications:

Offering accrued and unpaid interest on eligible bonds and a cash tender fee payment to holders of eligible bonds maturing in 2023.Increasing the new bonds offered by adding new instruments to the composition of the new bonds for a total of 12 new domestic bonds, one maturing each year starting January 2027 and ending January 2038.Modifying the exchange consideration ratios for each new bond.The exchange consideration ratio applicable to eligible bonds maturing in 2023 will be different other from other eligible bonds.Setting a non-binding target minimum level of overall participation of 80% of the aggregate principal amount outstanding of eligible bonds.Expanding the types of investors that can participate in the exchange to include individual investor.

On January 16, 2023, the government extended the deadline for the domestic debt exchange programme to January 31, 2023, after another resistance by some creditor group particularly individual investors whom the government promised not to include in the programme.

The government made some modifications including:

Offering accrued and unpaid interest on eligible bonds and a cash tender fee payment as a carrot to holders of eligible bonds maturing in 2023.(ii) Increasing the new bonds offered by adding eight new bonds to the composition of the new bonds, for a total of 12 new bonds, one maturing each year starting in January, 2027 and ending January 2038.Capital shortfalls are more likely to emerge for a tail of weak banks like A, B, E, D, G, J, K and few others because of their higher share of exposure to government domestic debt relative to their capital.

With the estimated losses using the NPV of banks holding of government bonds, the domestic debt exchange could also have a negative impact on the capital adequacy ratio of banks.

The recent domestic debt exchange program has led to a major debate about fair-value accounting.

From data analysis, nine banks could be insolvent, while six banks would be solvent and eight banks would experience mild capital losses as a result of domestic debt exchange as well as the application of IFRS 9.

Based on our analysis and the evidence in the literature, we have little reason to believe that fair-value accounting contributed to Ghanaian banks’ problems in the domestic debt crisis in any major way but it was as a result of weak and poor risk management in the banking sector as well as regulatory failure in compliance with the of Banks and Specialized Deposit Taking Act 2016 Act 930 (Section 62 (1) on limit on financial exposures.

Fair values play only a major role for banks’ income statements and regulatory capital ratios, except for a few banks with large trading positions.