Blame shareholders for job losses in Savings and Loans crash - BoG

Bank of Ghana has parried criticisms, its has resulted in another round of job losses.

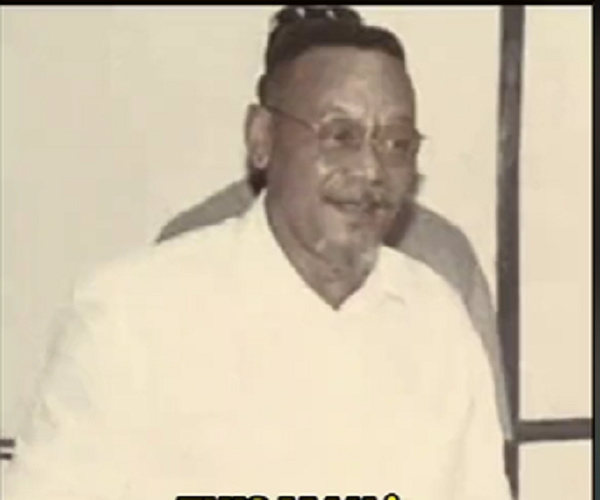

Deputy Director of Banking Supervision of the Bank of Ghana, Elliot Amoako said shareholders of the affected financial institutions are responsible for the job losses.

‘It is not the regulator that is creating the job losses, it is shareholders’ he said in an exclusive interview with the JoyFM Super Morning Show Sunday.

Photo: The full interview plays on the Joy FM Super Morning Show Monday

For a third August in a three-year row, the Bank of Ghana has revoked the licences of financial institutions, this time, Savings and Loans companies.

Big names like GN Savings and Loans (formerly GN Bank) Ideal Finance, Women’s World Banking were found to be operating well below the minimum capital requirement of 15m cedis.

Risky boardroom decisions and investing depositors’ funds into companies related to these shareholders top the list of bad governance practices that pushed these institutions in the red.

Like some banks, microfinance and microcredit institutions whose licences were withdrawn in August 2017 and August 2018 respectively, job losses are expected in this fresh August 2019 decision of the central bank.

Official figures for job losses are yet to be released. Elliot Amoako said the expected job losses are “painful” but this reality had been looming because of the bad decisions taken by shareholders of these institutions.

The Dep. Director of Banking Supervision at the central bank said some of the affected companies had been closed down long before the Bank of Ghana revoked their licences.

Several workers had been staying home. ‘I can assure you in most of these institutions, they could not pay workers salaries for months’ he said. “There was no hope,” he said.

Some shareholders were eluding depositors as their companies could not even honour 500 cedis request from their depositors.

A viral incident at Midland Savings and Loans in July 2018 showed a

Photo:In a video that has gone viral on social media, Skalla, was seen virtually punching and slapping a nursing mother in a banking hall.

Elliot Amoako said the Bank of Ghana had to contend with frustrated depositors trooping to their premises calling for the regulator’s intervention.

The regulating official decried a culture of abysmal governance in these Savings and Loans companies. “Some of them, it was as if they were on a suicide mission” Elliot Amoako expressed dismay.

Since August 2017, 418 financial institutions have lost their licences in the banking sector clean-up exercised embarked on by the Bank of Ghana.

Elliot Amoako has said the latest wave of revocations ends the clean-up exercise in the banking sector.