Good or bad? GUTA, AGI disagree on reduction of import duties

Two key trade associations, the Ghana Union of Traders Association (GUTA) and Association of Ghana Industries (AGI) have locked horns over the reduction in benchmark value of import duties.

Government that the benchmark value of import duties has been slashed by 50 per cent, while that for vehicles alone has been reduced 30 per cent.

Submitting their assessment of the tariff review on the business edition of PM Express on Thursday, GUTA touted the new import regime as progressive and responsive of the interests and concerns its members.

However, AGI said the reduction can cripple local manufacturing industries.

AGI Chief Executive, Seth Twum-Akwaboah, said although his Association is not against the recently introduced port reforms, a blanket application to goods imported is inimical to the Ghanaians manufacturing sector.

“I think that we need to really think through it very well. Because …applying 50% reduction on all goods, is problematic. Because if we look at the CET [ECOWAS Common External Tariff], the CET has different tariff bands to take into account certain industries within the sub-region – that we have some local capacities to produce those products and therefore they need to be protected a bit.

“There are those that we don’t have local capacities at all and therefore if you raise the tax so much you are only making the product expensive in your market. So they took all those things into account in setting the tariff bands, the AGI boss explained.

He said AGI members are of the view that a flat rate application of the tariff reform runs counter to government desire to encourage local production.

“Imports will become much cheaper than manufacturing and the implication is that those who are producing, those who are making the business of manufacturing in the country and employing people will turn into trading,” he said.

When manufacturers become traders to benefit from the import tariff reduction, the economy will suffer he said.

GUTA

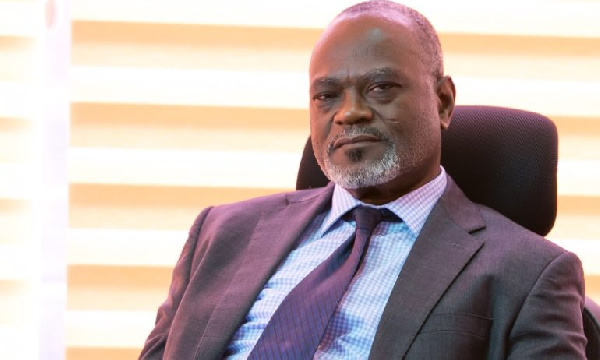

But GUTA President, Dr Joseph Obeng disagrees.

He said, the AGI’s argument is flawed because the benchmark value reduction is not limited to finished goods only.

“It goes right down to raw materials. So the status quo remains the same. If you want importation to banned, you should be bold and tell the government that ban importation, but can it be done? It can’t be done because importation is very necessary. It is only helping what we locally generate.

“It is not possible to manufacture everything, you have to see where you have a competitive edge and produce it. The rules must not be bent for you alone,” he advised.

Gov’t explains benchmark import duty reduction

The initiative, according to Vice President Dr Mahamudu Bawumia is designed to reduce the high cost of clearing goods at the country’s ports, boost import volumes, and make the country competitive within the West Africa sub-region.

Speaking as head of the Economic Management Team (EMT) at a town hall, he explained: “The benchmark values applied by Customs to various commodities in the computation of import duties at Tema are much higher than in Lome, Abidjan and Dakar. In many cases, they are 100-200 per cent higher.

“If you take for example a Ford Focus 2009 model and you go to Tema, our benchmark would say it is worth $9,000. If we go next door to Lome, the same car they benchmark at $3,000; and the same car in Dakar is exactly the same price of $3,000.

“So, it is a problem, and we end up paying double the duty because the benchmark values are so high vis-a-vis Lomé and Dakar.”

Government is confident that the reduction in benchmark values will increase container volumes and boost its revenue at the ports.

Between 2013-2018, Lome Port recorded a 300 per cent increase in container volumes (60 per cent annually), while Ghana recorded just a 4.1 per cent increase in container volumes between 2013-2016.