SG Ghana to support local SMEs with over ¢700m funding

Societe Generale has expressed its readiness to support Small and Medium-sized Enterprises (SMEs) with more than GH¢700 million funding.

According to the bank, the support is part of its global growth strategy for this year and also in the bid to support the development of the country through small businesses.

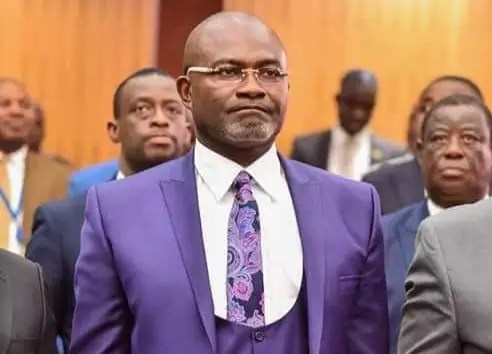

Speaking to JoyBusiness after his outfit’s engagement with the media, Managing Director of SG Ghana, Hakim Ouzzani said, “We have for the three coming years, more than GH¢700 million, as an envelope for the financing of the SMEs in Ghana.”

He added, “It reflects all the importance we (the bank) are affording to SMEs in Ghana because we believe that the SMEs of today will be the big enterprises of tomorrow, and we believe they will help the country not only to grow but to improve for example, the exportations as substitution to import in Ghana.”

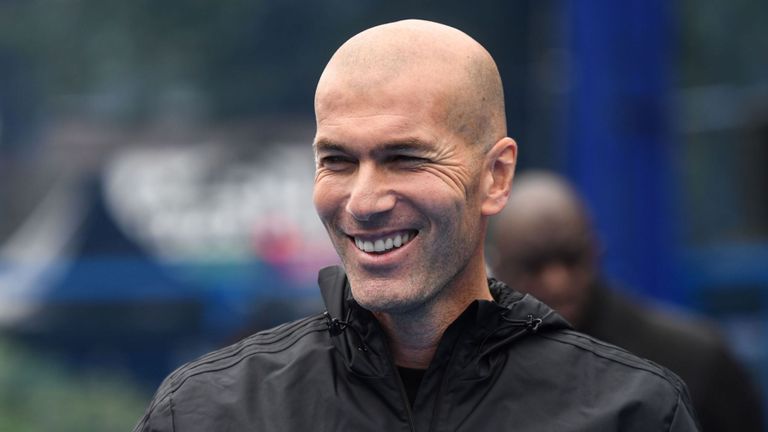

On his part, the Head of Africa and Overseas Region of Societe Generale, Alexander Maymat, explains the role of the banking sector to control the country’s increased debt stock.

“If you compare the indebtedness level of a country like Ghana which is around 30% of the GDP globally with the situation in China which is around 140%, it means that there is very important room for increasing the capability of the banking sector and of banking lending to contribute in financing investments that are necessary to develop your countries.”

He added “one of the important roles of a bank like Societe Generale is to put in place much more private sector lending facilities that will take the place of the public sector in financing the investments that you need.”

“Grow with Africa” programme

The main objectives of this programme are to foster development of the economies and populations through multi-dimensional support for SMEs, infrastructure financing, innovative financing solutions and financial inclusion. One of the initiatives is the creation of SME centers across Africa to provide resources for business development.

This will come in addition to the bank’s decision to increase access to credit to support SMEs, which are the cornerstone of African economies.

Infrastructure financing is another key aspect of development in Africa, especially in energy, transport, water and waste management, and even the development of smart cities.

Societe Generale plans to double its workforce dedicated to structured financing by the end of 2019 and increase its financial commitment related to structured finance in Africa by 20% over the next three years.

Under innovative financing, and with a special emphasis on Agricultural Industries and energy partnerships, the bank is planning to provide access to a range of banking and non-banking services (Healthcare, Education, Advisory and more) to one million farmers over the next five years.

This target is being made possible by YUP, the bank’s online Mobile money platform that brings finance to the doorstep of everyone.

On promoting development through financial inclusion, this objective is born out of the strong conviction that there is a real need for alternative banking models to accelerate financial inclusion across Africa.

About 80% of the African population remains unbanked and microfinance remains crucial to integrating this section of the population that has not accessed the traditional banking system.

In this vein, new distribution models that use mobile devices is a more practical approach to serving this unbanked populations.

Under this strategy, the approach is in twofold; first, working through partner Microfinance agencies to expand the scope and sustainability of client’s activities. Second, the bank will continue to roll out YUP, which offers simple, accessible, bank-like products to a broad population, the majority of whom does not currently have access to banking services.

Alexander Maymat said, “Societe Generale’s experience in Ghana is an exciting one; the country is developing fast and so are the needs of our clients.”

He added, “Clients are finding in Ghana their own way to consume banking products and services, and we believe that our unique positioning which combines knowledge of the local economies and the expertise of an international banking group are key to support the country’s development.”

Societe Generale’s desire to contribute to sustainable development in Africa is also driven by the initiatives of the bank’s Corporate Foundation for Solidarity.

The foundation has already supported close to 100 projects promoting professional integration in 14 African countries, and the budget it dedicates to projects in Africa will be considerably increased over the coming years.