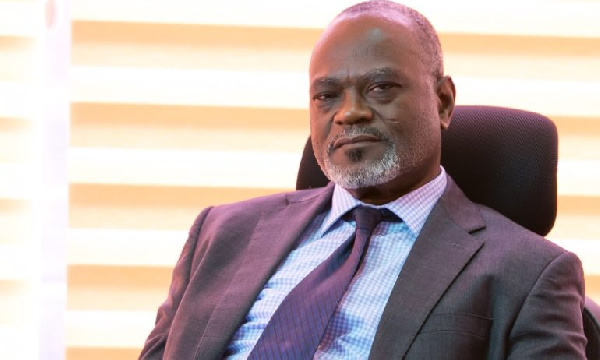

Minority rejects government’s debt restructuring programme

As a critical part of the ongoing negotiations with the International Monetary Fund to secure Ghana $3 billion in support for the economy, the government is exchanging already sold bonds for new ones with a more flexible interest payment plan.

.The Government on Sunday announced a slash in interest payments for domestic bondholders to zero percent in 2023 and pegged 2024 interest payments at 5 percent.

According to the government, there will be no haircut on the principal of bonds, adding that individuals with government bonds will have their full investments upon maturity.

He further announced that interest payments for domestic bondholders for 2024, will be pegged at only 5% adding that from 2025, the rate increases to 10%.

“Under the domestic bonds exchange programme, domestic bondholders will be asked to exchange their instruments for new ones

Existing domestic bonds as of 1st December 2022 will be exchanged for a set of four new bonds maturing in 2027, 2029, 2032 and 2037.

“The annual coupon on all these bonds will be set at zero percent in 2023, 5 percent in 2024 and 10 percent from 2025 until maturity… In line with this, treasury bills are completely exempted, and all holders will be paid the full value of their investments on maturity