Avnash Industries laments effect of benchmark discounts on local rice production

Avnash Industries is worried that maintaining the benchmark value discounts on imported rice will spell doom for the local industry.

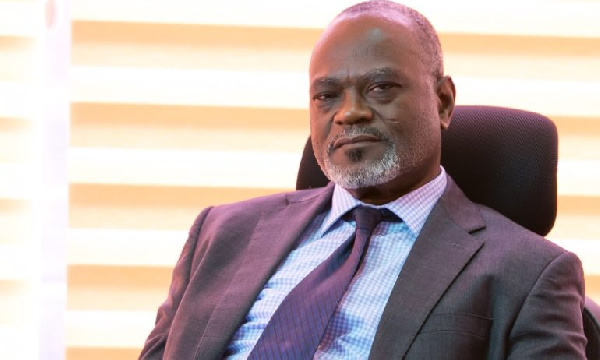

David Selorm Adeka, the Head of Marketing for Avnash, said the policy has handicapped local rice producers.

“As we started buying [the rice], we were unable to sell and this is because when we put that rice on the market, considering the price at which we bought it, it was not competitive,” he said on the Citi Breakfast Show.

Currently, he said, local rice goes for about GH¢40 for 5 kg per bag, while imported rice goes for between GH¢25 and GH¢35.

Because of the favourable environment for importers, Mr. Adeka complained that foreigners were benefiting more from the benchmark policy than Ghanaians.

“Togo and Ivory Coast are taking advantage of us because when products come from Togo and Ivory Coast into Ghana, they are enjoying 50 percent discounts. They have 3 percent VAT. When we produce, we have to charge 19.5 VAT to the market.”

Mr. Adeka warned that Ghana needed to follow in the footsteps of countries with import substitution policies.

“We are in global competition and if we can’t do what others are doing then we are finished already. This sends a very bad signal to anyone who is interested in investing in our rice sector.”

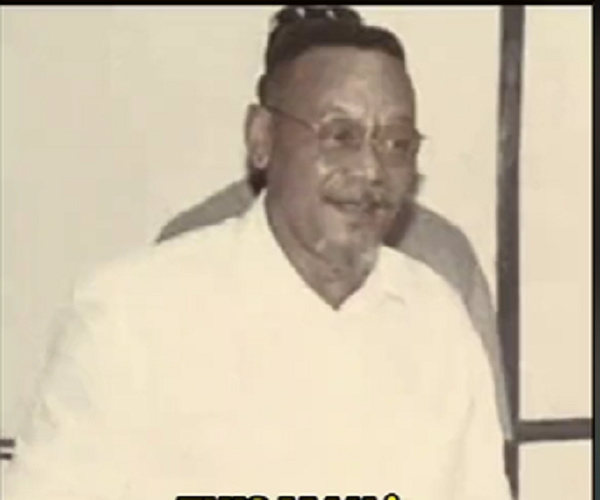

Also, on the Citi Breakfast Show, Kenneth Koomson, the General Secretary of the Food and Allied Workers Union, held brief for workers who may be indirectly affected by benchmark policy.

He explained that local rice producers are being compelled to sell their produce at a higher price.

“After 2019, you are seeing a price build-up, which is about GH¢20 to GH¢30 higher for the local manufacture compared to the importer.”

“Ghanaians must be given the opportunity to make a choice based on quality, based on preference, and not because of price,” he added.

The oil production division of Wilmar Africa Limited, a wholly-owned subsidiary of Wilmar International, is facing imminent closure over the harsh economic situation it is facing.

At the oil production division of Wilmar Africa Limited, which is expected to shut down because of economic struggles, Mr. Koomson said up to 5,000 employers could be impacted.

He cautioned further that the same could happen to other persons and companies along the supply chain for various products.

“Once the processing plant goes down, it means they are not going to sell to anybody and for that matter, they have to shut down,” Mr. Koomson said.

Source: citifmonline.com