Invest in technology for business growth – SEC boss to financial institutions

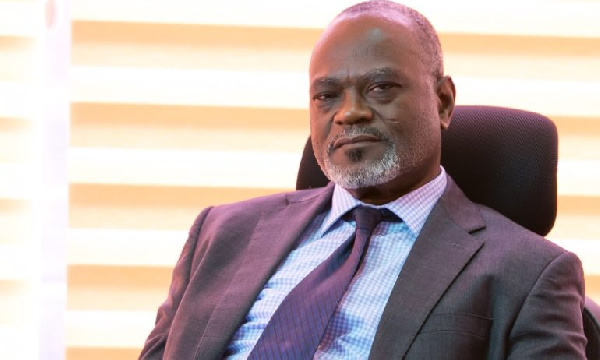

The Director General of the Securities and Exchange Commission, SEC, Rev. Daniel Ogbarmey Tetteh, has emphasized the need for financial institutions to leverage on technology for business growth.

According to him, the impact of information and communication technology (ICT) in the financial economy has become increasingly apparent considering the impact of the novel Coronavirus on the securities industry.

The Director General who was the guest speaker at the 2020 GIMPA Law School Webinar Conference, also cautioned financial institutions against cyber fraud as the COVID-19 pandemic has brought with it a significant increase in fraudulent activity.

“In the case of assets under management, there seems to a balance between withdrawals and new investments. What is clear is the need for investment in ICT driven service delivery platforms. As someone has said, the new normal means that work is no longer a place you go but what you do. We expect our licencees to invest more in ICT and also take note of the potential threat of cyber risk. We expect our licencees to rely on ICT to ensure adequate disclosure and engagements with the investing public,” he said.

He also urged businesses within the sector not to relent but rather frequently review their business models to meet the changing trends.

“As a Commission, we recently issued guidelines on holding virtual annual general meetings for the guidance of listed companies and market intermediaries and we expect that the firms would retain the option of using virtual platforms in addition to the traditional in-person meetings beyond the Covid-19 era. We have also given direction to the market to do electronic submissions to the Commission. Without doubt, this period also calls for all to interrogate the business and operating models in order to stay relevant,” he said.

Following the outbreak of the novel Coronavirus, many governments made full use of digital technologies to confront a wide range of pandemic-related issues.

Banks withstand COVID-19 shocks, SDIs hit hard – BoG Report

A new report by the Bank of Ghana has established that even though banks have been resilient to shocks amidst the Covid-19 pandemic, the same cannot be said for Specialized Deposit-Taking Institutions such as Savings and Loans Companies and Microfinance firms.

The report, which was conducted by the central bank for the first quarter of this year, that’s from January to May, also showed that Ghana’s financial sector saw an increase in cash withdrawals largely due to the pandemic and its attendant impact.

Source: citifmonline.com