Customers of defunct fund management companies stranded at validation centres

Hundreds of customers of some defunct Fund Management Companies have been left stranded at validation centres in various parts of the country after trooping in to selected branches of the Consolidated Bank Ghana Limited (CBG) as part of processes to retrieve their locked up monies.

The Security and Exchange Commission (SEC) set today, November 18 as the start date for the affected customers of closed down fund management companies to begin processes that will lead to capped payments.

In Adum in the Ashanti Region, some customers told Citi News of the difficulties they had faced with the process.

“We have taken it upon ourselves to write down our names. We need our monies and that is why we are here. Banks open at 8:30 am but since we got here, no official has come to speak to us yet. We haven’t heard anything from Papa Kwesi Nduom. Nobody is communicating anything sensible to us,” one gentleman cried.

Some of the investors with the defunct companies who have been gathered at the CBG office in Ho say they hope that the process will be expedited for their monies to be paid them.

“We’re here for validation today. Those who are to do it have not come. We don’t know our fate yet but we’re still in the balance. We are not too sure we’ll get our money but we’re sure that whatever we’ll do should be seriously taken on the government so that is will not be a nine-day wonder where we’ll come and stay in the sun from morning to evening and nothing will come out of it,” a worried man said.

“Today if government has stepped in that we should come for validation, I think it’s in the right direction. I don’t know whether they are coming to pay all the money or part of it but we are still waiting for the officials from Accra,” another said.

Also in the Northern Region, customers who have queued at the premises of CBG in Tamale to provide evidence of their investments have been told to write their names and return tomorrow.

Some of them spoke to Citi News.

One lady indicated that: “A lot of people are here. The queue is too long but they said that the people are yet to dispatch from Accra so we should just write our names and go and come back tomorrow. The people from Accra will come and meet the management here and will give us whatever information and the schedule in which the will do the validation.”

“I came to meet 28 people when I got here around 5 am and we wrote down our names. I am appealing to SEC and the government to make sure that they pay us all of the amount of money we invested,” a gentleman said.

Background

Weeks ago, the Securities and Exchange Commission (SEC) revoked the licenses of 53 Fund Management Companies.

SEC, in a statement explained that the revocation follows the companies’ failure to “return client funds which remain locked up and in a number of cases, have even folded up their operations.”

The action was taken pursuant to Section 122 (2) (b) of the Securities Industry Act, 2019 (Act 929) which authorizes SEC to revoke the license of a market operator under some circumstances.

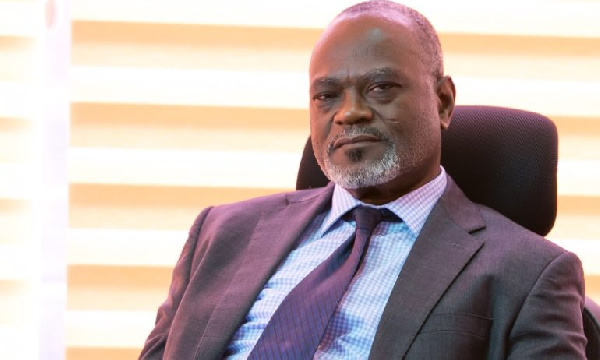

Included in the list of the defunct companies was Black Shield Fund Management, a subsidiary of Groupe Nduom.

The company, formerly known as Gold Coast Fund Management had been in the news in recent times over continuous complaints from its customers about their inability to withdraw their investments.

Meanwhile, the Securities and Exchange Commission has advised customers not to engage in panic withdrawals but rather educate themselves and do the needful.

“In the interim we urge all investors to remain calm, gather all receipts, statements and any other documentation related to their investment with the affected institutions. There is also no need for any panic withdrawals on the firms whose licenses are intact and not on the revocation list. A list of firms whose licenses have not been revoked can be found on the SEC website (www.sec.gov.gh)”.

On the back of this, SEC selected branches of Consolidated Bank of Ghana Limited (CBG) to receive claims from clients who have their funds locked up at the affected companies.

The banks were tasked to accept relevant documents for the validation of the investment claims.

According to SEC, the said branches serving as agents were authorized “to ascertain and validate details of investors and their investments with these institutions at the time of the revocation to facilitate the administration of the Government pay-out of a capped amount to affected investors.”

Source: citifmonline.com