It has emerged that the board of the now defunct uniBank, did not follow any of the key good corporate governance rules outlined by the regulator of the financial sector, the Bank of Ghana.

Even when the central bank had cautioned the board of uniBank not to advance loans, the board went ahead and granted loans to parties related to the company under circumstances that hurt the financial base of the company.

“The Bank procured and paid approximately GHS57.6 million to related entities for goods and services from January 2017 to date, without an objective assessment for value for money after a BoG directive to cease giving loans in October,” a new document sighted by Citi News has stated.

In addition, the bank is said to have incurred staff cost of approximately GHS7.4 million that had been seconded to related party companies from January 2017 without it being refunded.

According to the document, even though uniBank’s governance and operating framework was broadly fit for purpose, the board and management did not adhere to the established framework.

It pointed out that, “the endemic culture of non-compliance contributed to the continuous deterioration of capital, notably in more recent periods, and contributed to the bank’s inability to operate a profitable and compliant business”

Bad board operations

The document stated that the composition and operational policies of the board did not drive independence and effective oversight of key governance and management activities.

For example, the Chairman of the Board served on five out of six sub-committees of the board, in addition to chairing three out of the five sub-committees.

There was also insufficient numbers of independent non-executive directors.

By this, only two out of the eleven directors were identified as independent non-executives.

More revealing, the document stated that two members of the board were directors of two other related parties, regulated/financial institutions—uniBank and uniSecurities.

Credit risk management

Over all, the document stated that the credit risk management framework of the bank of did not function effectively.

The low quality of the bank’s loan portfolio was as a result of non-compliance to loan approval limits.

The board also went ahead to grant loans to related parties under bad conditions that were injurious to the financial base of uniBank.

uniBank was overstaffed compared to other banks

The new document sighted by Citi Business News also shows that the now defunct uniBank was overstaffed compared to its others in the banking sector, causing a drain on the financials of the company.

According to the document, uniBank prior to the revocation of its license had 811 permanent staff, 64 contract staff , 990 outsourced staff and 79 National Service Staff for a bank with just 54 branches.

That was not all, the bank also had related entities whose staff depended on it for financial support.

In the breakdown, the permanent staff of the related entities were 1,284, contract staff of 244, outsourced staff 200 and 20 National Service personnel.

Background

The Bank of Ghana consolidated five local banks into what it calls the Consolidated Bank Ghana limited.

The banks were Beige Bank, Construction bank, Royal bank, uniBank and Sovereign bank.

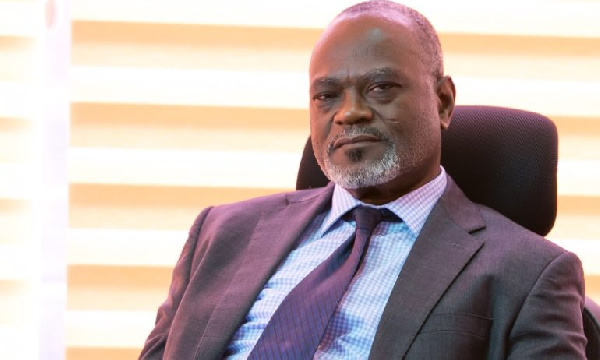

According to the Governor of the Bank of Ghana, Dr. Ernest Addison, some of the banks obtained their licenses through false means by presenting documents that painted a picture as though they could meet the new capital requirement.

uniBank prior to the merger was put under an administrator, KPMG after the bank was insolvent and faced liquidity challenges.

By: Lawrence Segbefia/citibusinessnews.com/Ghana

Source: citifmonline.com